Marin County Real Estate Market Report February 2018

40 Twain Harte Lane in San Rafael — Now in Escrow

Welcome to my February 2018 Marin County Real Estate Market Report! You will notice something very different in the charts this month. Each month we see green arrows on the pricing chart, indicating price increases from the prior month, and we see red arrows on the inventory chart, reflecting tighter and tighter inventory in the Marin County real estate market. However this month we see prices have declined from the prior month and inventories are up.

So what gives? Is this a market shift? I would venture no. Remember that December is a very slow time for real estate, so the relatively small number of transactions can distort the data as we compare January to December. In addition, we see that pricing is up versus the same month in 2017, so we are still seeing strong year-on-year appreciation. It is a picture that illustrates why some savvy buyers take advantage of winter to purchase a home.

The spring-like weather, though it is still winter, seems to have awakened buyers and sellers. I have several exciting listings coming up, and we are seeing homes beginning to come on the market. I am working with several buyers right now who are looking to diversify their investments by increasing exposure to real estate and decreasing exposure to the stock market.

Will Stock Market Volatility Impact the Housing Market?

If you normally scroll past the Wells Fargo national market update below, I would encourage you to read it this month. Wells Fargo contends that stock market volatility could be good for the housing market because it was triggered by good economic news that resulted in interest rates moving up and stocks moving down. I am not an economist so I won’t analyze their opinion, but I have seen people want to “park” cash in real estate when the stock market is volatile because they want to own a tangible asset, not a “piece of paper,” meaning a stock. This could be good for the market as long as buyers’ down payments are not negatively impacted by the stock market.

It remains to be seen if the recent volatility was a blip or a trend. A significant correction would most likely have an impact on the Marin County real estate market as many buyers and sellers are heavily invested in the stock market. It is worth watching. Most observers point to continued job growth in the bay area which should continue to put pressure on housing prices and inventory.

I still am optimistic about the market in 2018 and am starting to think about spring gardening and planting my annual tomato crop. I hope you are enjoying this unusually warm weather we are having.

I am never too busy for your referrals, questions, or if you just want to talk about the Marin County and SF Bay Area real estate market. Please call me at 415-847-5584. Remember, many great conversations begin with a single question.

MarinScoop – My New Newsletter – Is Here!

I am pleased to announce that I kicked off my new monthly Marin County Real Estate & Lifestyle Newsletter last month. I plan to include links to blog articles and these market reports in the newsletter, along with featured listings and other items I hope you will find interesting. Please click below to subscribe. I will be eager to hear your feedback and suggestions!

Marin County Real Estate Market Report February 2018 Dashboards

Marin County Real Estate Dashboard:

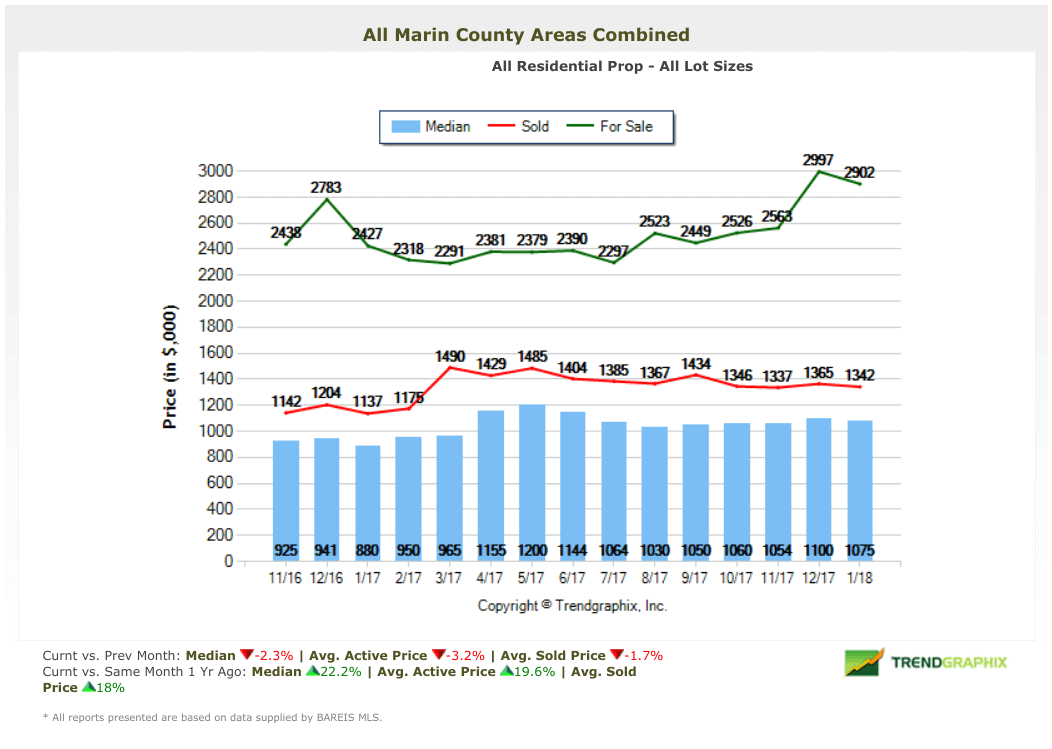

Home Prices

For sale prices decreased by 3.2% versus last month and increased by 19.6% vs. the same month a year ago.

Average sold prices decreased by 1.7% vs. last month and increased by 18% vs. the same month a year ago.

The median home price decreased 2.3% versus last month and increased 22.2% vs. the same month a year ago.

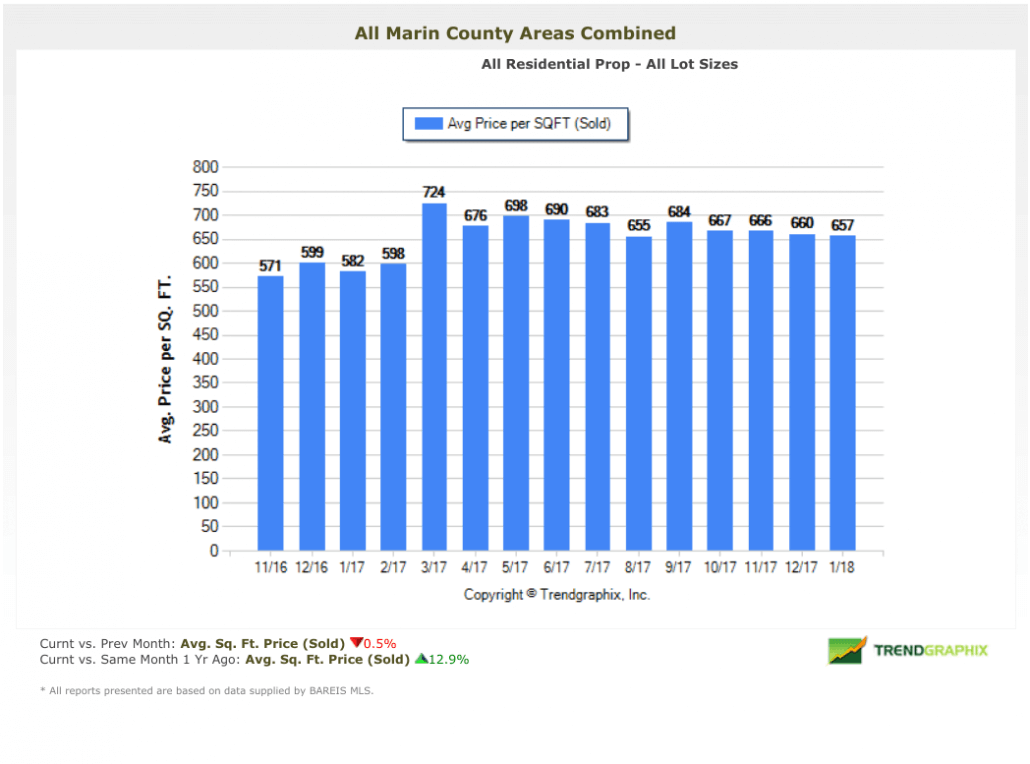

The average price per square foot sold decreased by 0.5% vs. last month and increased by 12.9% vs. the same month last year.

All information courtesy of and copyright by BAREIS MLS and TrendGraphix.

Dashboard compiled by Thomas Henthorne, all rights reserved.

Marin County Real Estate Dashboard:

Inventory

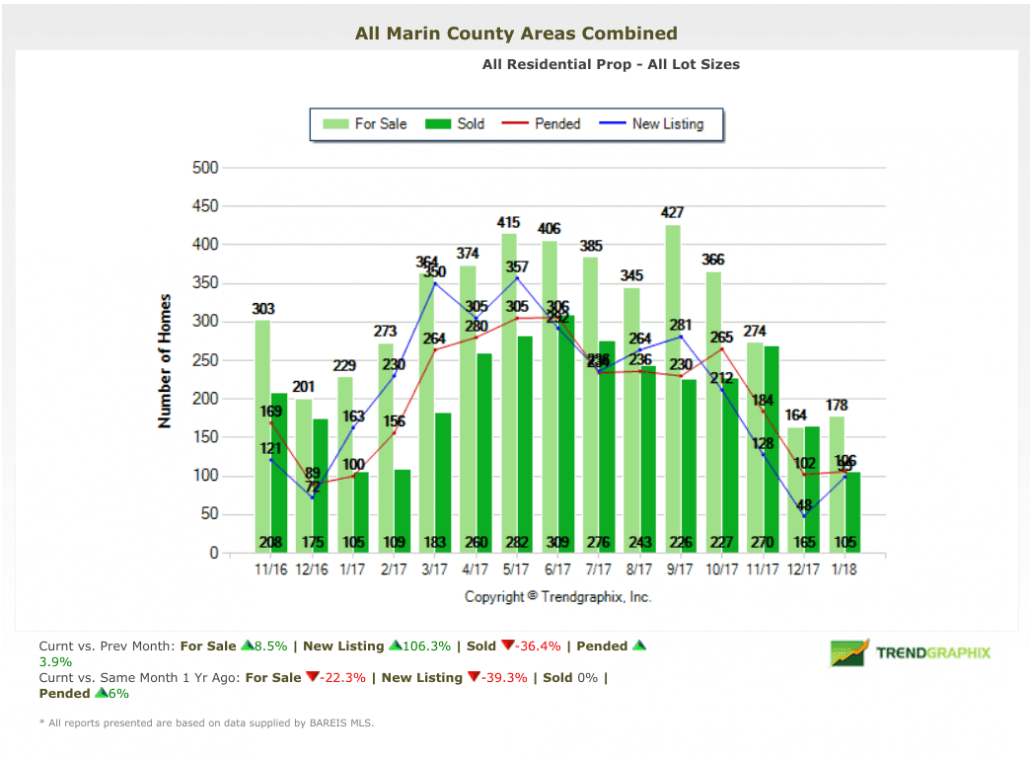

Number of homes for sale increased 8.5% vs. last month and decreased 22.3% vs. the same month last year. New listings decreased 39% versus the same month last year.

Number of homes sold decreased 36.4% vs. last month and were flat to the same month last year.

Months of inventory is up 70% vs. last month (off a very low base) and down 23% compared to the same month last year.

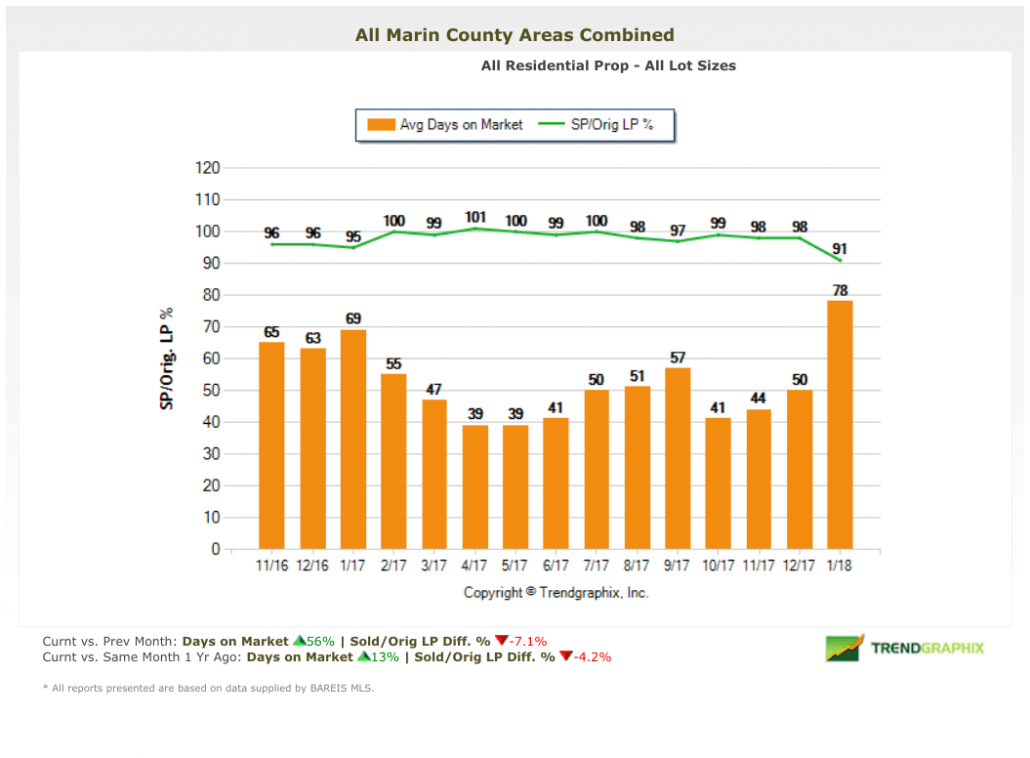

The average days on market increased by 56% vs. last month and increased by 13% vs. last year.

All information courtesy of and copyright by BAREIS MLS and TrendGraphix.

Dashboard compiled by Thomas Henthorne, all rights reserved.

National Real Estate Market Update

Courtesy of Wells Fargo:

“Rising Rates Provide an Early Test for Housing”

The spike in long-term interest rates and the stock market sell-off that followed closely afterward provide an early test of the conviction of forecasts for a stronger spring home buying season. Bond yields rose faster than expected at the start of year, as expectations for economic growth ramped up on stronger reports of manufacturing activity, employment and wage growth.

Estimates for GDP growth have been ratcheted up, largely on the hopes that capital spending will grow more rapidly than in past years. We are also expecting healthy gains in home sales and new home construction but both will continue to be constrained by supply concerns (too few homes for sale, lots to build on, workers to build homes) and affordability challenges (home prices have risen much faster than incomes). We find it instructive that the proportion of consumers that believe now is a good time to buy a home has continued to trend lower in recent months, largely due to the continued rise in home prices and lack of homes available for sale. This is why we continue to look for only modest gains in home sales and new home construction, even though we expect much stronger overall economic growth.

The recent stock market volatility may prove beneficial to the housing market. The market sell-off was triggered by stronger economic growth, including the Atlanta Fed’s optimistic 5.4 percent first-quarter real GDP forecast and January’s blockbuster employment report, which included a 200,000-job increase in non-farm payrolls and 2.9 percent year-to-year rise in average hourly earnings.

So is the good economic news too good for our own good? We doubt it. The stock market had gone more than two years without a 5 percent correction and a reset was long overdue. We doubt the market sell-off will reverberate back on the real economy. In fact, the market sell-off will likely temper the rise in long-term interest rates and throw a little cold water on all the talk that the Fed has fallen behind the curve in removing all the policy accommodation put in place since the Great Recession. A more modest and gradual rise in interest rates would allow the housing market to continue to strengthen along with the overall economy. We are keeping our housing forecast unchanged from where it was one month ago.

What This Update Means For You

SELLERS: If you’re thinking of selling your home, don’t listen to your Uncle Fred at dinner who says it is a sellers market and buyers will pay anything. Buyers are well educated and the majority in Marin County are working with very experienced and savvy agents who know values. Keep an eye on some of the trends we are seeing — that while inventories remain tight, sellers are having a hard time pushing pricing higher than last year. Bottom line: price your home for this market, not for the market in early 2016.

BUYERS: For home buyers, the good news is that more balance is coming to the Marin real estate market even though inventories are tight. Look for homes that are well-priced and be prepared to move quickly. Chances are you are looking for the same things most other buyers are also seeking (see my list below.) Set up property alerts on my website so you can immediately see new homes on the market, and make sure you are pre-qualified so you present a compelling offer. (You may wish to read my article Buying a Home in Marin County for more tips and advice.) One other tip: Ask your agent to run aged inventory reports in and above your price range. Sometimes there are some real gems that the market has overlooked due to pricing or other factors.

What Are Buyers Looking For Right Now?

In speaking with buyers, they want it all right now, with the following at the top of their lists:

- Great schools

- Single-level

- Easy commute

- Walk to restaurants and shops

- Views

- Quiet streets

- Remodeled homes in move-in condition

Smart buyers, which is almost all of them, realize they cannot have all of those attributes and buying a home in a market like Marin County is a series of tradeoffs. For example, they may choose to give up walking to restaurants to be in the hills with a view of the bay. In any event, we are seeing buyers that are more tech-savvy than ever and who have done their homework, reading market reports such as this one and spending a lot of time online looking at homes.

Wondering If You Should Buy or Rent?

This handy calculator is a great place to start. Then give me a call and let’s discuss.

Featured Listing – 28 Teaberry Lane in Tiburon

Stunning Newly Constructed Private Estate in Tiburon With Bay, Mountain and Bridge Views

Thomas holding the first open house Sunday 2/11 from 1-4 pm

Offered by Lydia Sarkissian and Bull Bullock for $8,500,000

Call Thomas at 415-847-5584 to Arrange a Private Viewing

Marin County Real Estate Market Report Charts

(click any slide to enlarge & launch slideshow)

“For Sale” vs. Sold Home Prices vs. Median Home Prices

Marin Home Prices List Price vs. Sold

Marin County Months of Inventory Based on Closed Sales

Average Price Per Square Foot

Marin County Number of Homes on the Market

Would you like to see this data for your town only?

I am also now rolling out market update charts for selected towns in Marin. Please click the below for local real estate market updates & charts:

Kentfield Real Estate Market Update

Mill Valley Real Estate Market Update

The Golden Gate Sotheby’s International Realty Annual Market Report covering the entire bay area is now out. Please click here to read the report.

I hope you have found my Marin County Real Estate Market Report informative. Please feel free to add your comments, questions or suggestions in the comments section below. If I may be of any assistance in helping you attain your real estate goals, please call or text me at 415-847-5584 and I will be in touch right away.

What do YOU think? What would you like to see in this report going forward? Please leave your comments in the section below.

Excellent point — “relatively small number of transactions can distort the data as we compare January to December. In addition, we see that pricing is up versus the same month in 2017, so we are still seeing strong year-on-year appreciation.” The Harte Lane property is absolutely stunning.

Thank you, Judy… 40 Twain Harte is now in escrow!