Marin County Real Estate Market Report April 2018

Check out my new Sausalito Homes for Sale Page Here

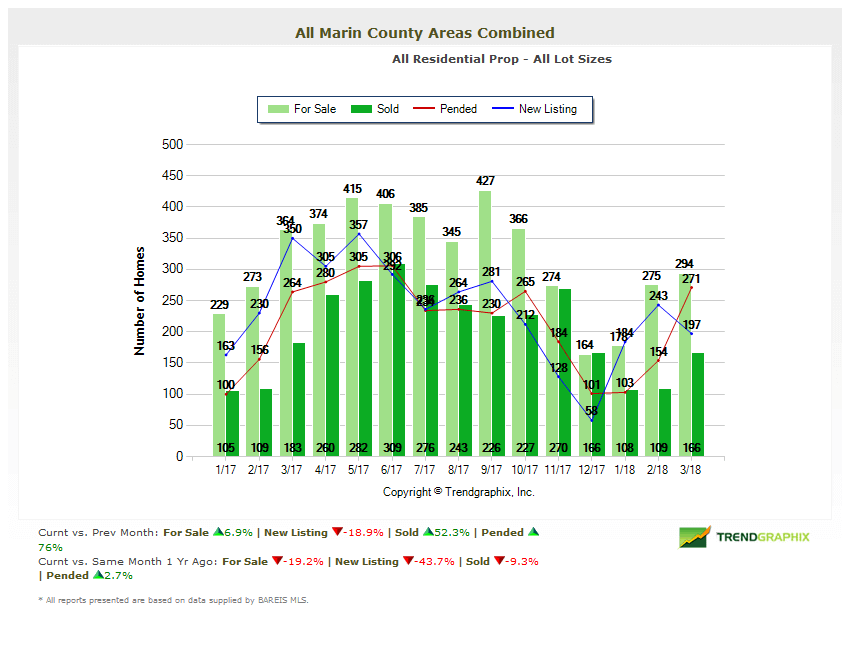

Welcome to my April 2018 Marin County Real Estate Market Report! This month one number really stands out: We saw 44% fewer new home listings in Marin County in March 2018 compared to March 2017. The housing inventory crisis that is plaguing the country has not spared Marin. At the same time, we are seeing prices increase, with the median sold price up 24.4% versus March 2017. The average sold price, which is affected by the percentage of homes at different price points on the market and more subject to skewing by pricing outliers (high or low), decreased by 3.1%. Please scroll down to see the charts with all the numbers.

So what gives? Normally I see a lot of homes hit MLS and my Top Agent Network feed each week this time of year, but in 2018 it is more of a trickle. Some are blaming it on a colder and longer winter than usual. (I still haven’t planted my tomatoes, and usually they are in the ground by now.) Others point to a stock market that has been extremely volatile in recent months (read more about this, below). The California Association of Realtors has one idea to help encourage those over 55 to move (more below). Whatever the cause is, the numbers speak for themselves and the environment is very challenging for buyers who want to get settled before school begins in the fall.

I am fortunate enough to have several listings coming up, with two in Greenbrae preparing to launch, one in San Anselmo, and several in San Rafael. If you are a buyer looking for a home, please call me and I will turn over every stone to find your dream home for you. Right now, I am seeing more homes sell without even going on the market. I looked at a gorgeous home on Rock Road in Kentfield that was staged and ready to hit MLS, but was never seen by the public because it sold over asking as top Marin real estate agents previewed it for their clients.

If you are a buyer looking only at online portals such as Redfin or Zillow, and not working with a well-connected agent, you’re not seeing all of the homes available in Marin County.

The California Property Tax Initiative

Did you know that nearly three-quarters of homeowners 55 years of age or older have not moved since 2000? The current property tax structure in California effectively discourages many from downsizing later in life as they may be faced with property tax increases of 100-300 percent if they move.

The California Association of Realtors has a proposal to solve this, and it will be on the November ballot. It is called the California Property Tax Initiative, and would allow homeowners 55 years of age or older to transfer their Proposition 13 tax base to a home of any price, located anywhere in the state, any

number of times. These protections would also be extended to people who are disabled (“differently abled”) and to those who have lost their homes to a natural disaster. They say it’s a carefully written initiative that includes appropriate safeguards while eliminating California’s property tax “moving penalty.”

You can read more about this idea, along with arguments against it, in this recent article on Realtor.com.

We are sure to hear more about this initiative between now and November 2018, but the theory is by allowing people over 55 to take their low property tax rate with them when they move, we will see more housing inventory in California as seniors move out of homes that no longer suit them. What do you think of this idea? Please add your comments in the comments section at the bottom of this article.

Rising Interest Rates and a Volatile Stock Market

The story this month is the impact of rising interest rates on the local and national housing market. Fannie Mae Chief Economist Doug Duncan recently raised his year-end 2018 mortgage rate forecast from 4% to 4.4%. As he did this, he said, ““However we don’t expect rates to play much of a role in total home sales, especially with anticipated stronger disposable household income growth.”

Some economists are forecasting mortgage rates at 5% by the end of the year. Crossing the 5% threshold could have a significant impact on both housing affordability and buyer sentiment.

You may wish to read these recent articles about the impact of rising mortgage rates:

Mortgage Rates Will Spike Faster, Higher Than Originally Projected

Is It Last Call for Low Mortgage Rates? Why Home Buyers Should Act Now

With Home Prices and Interest Rates Rising, How Much Could Mortgage Bills Grow?

The “Wait and See” Market Approach

In addition, the stock market has experienced volatility not seen since the mortgage crisis 10+ years ago. The week of March 18th alone the stock market declined by 1400 points. Economists remind us that these large point swings, while concerning, are smaller percentage declines given the market’s heights.

I am not an economist, but I am hearing more friends and clients say they are going to “wait and see” what the market does before making any large moves. This “wait and see” approach could be one of the factors that is driving the lower housing inventory in 2018 versus 2017. If we do see a full-fledged market correction take hold, we could see an influx of housing inventory as sellers decide to sell before further declines.

As I always say, my crystal ball is at the cleaners, but I thought I would share some of what I am reading with you. How are you feeling about the current market? Please feel free to leave your thoughts in the comments section at the bottom of this article.

These market reports are a great place to start — but let’s continue the conversation. Call me at 415-847-5584 and I can provide you with a personalized market overview tailored to your specific situation.

Marin County Real Estate Market Report April 2018 Dashboards

Marin County Real Estate Dashboard:

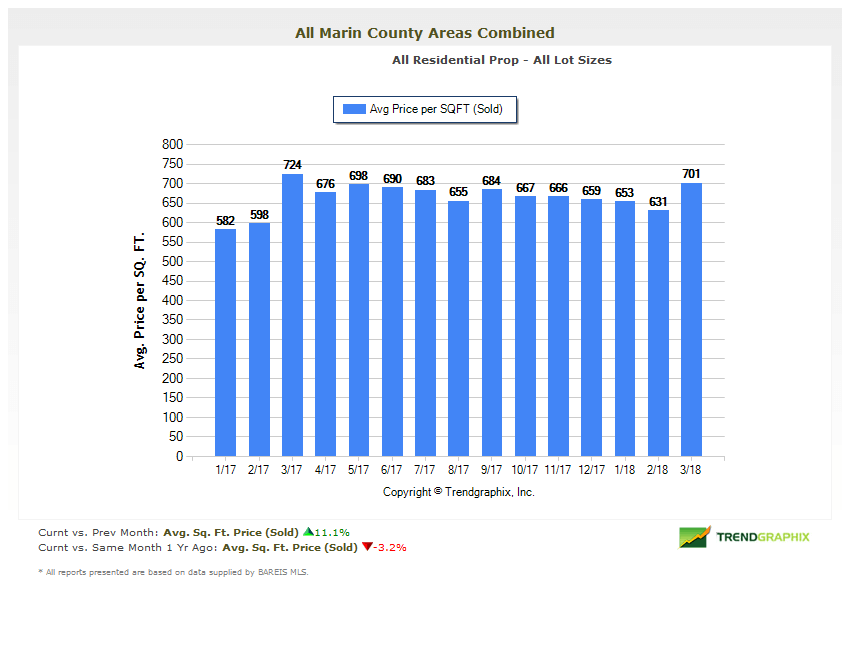

Home Prices

For sale prices increased by 7.2% versus last month and increased by 13.2% vs. the same month a year ago.

Average sold prices increased by 12.1% vs. last month and decreased by 3.1% vs. the same month a year ago.

The median sold price increased by 16.5% versus last month and increased 24.4% vs. the same month a year ago.

The average price per square foot sold increased by 11.1% vs. last month and decreased by 3.2% vs. the same month last year.

All information courtesy of and copyright by BAREIS MLS and TrendGraphix.

Dashboard compiled by Thomas Henthorne, all rights reserved.

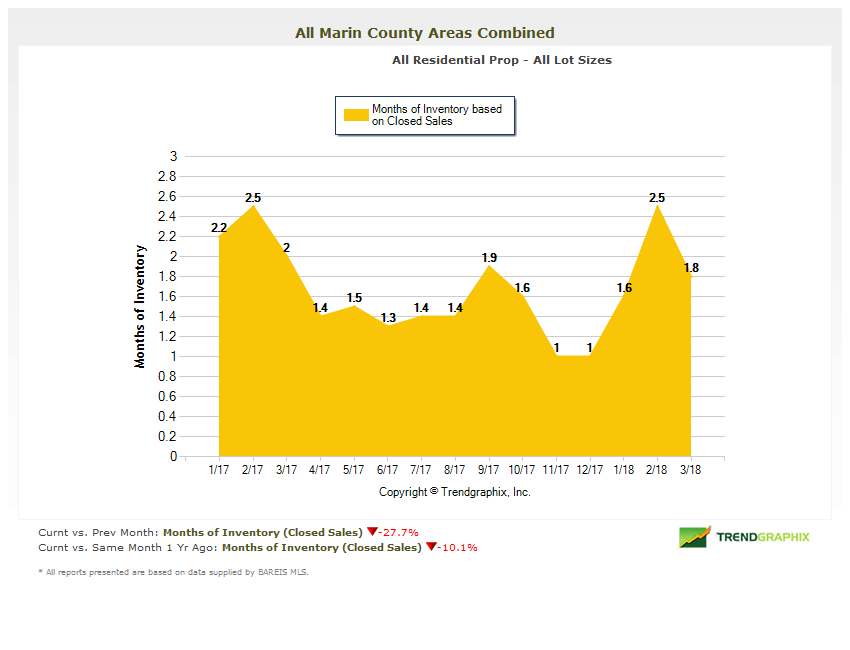

Marin County Real Estate Dashboard:

Inventory

Number of homes for sale increased 6.9% vs. last month and decreased 19.2% vs. the same month last year. New listings decreased 44% versus the same month last year.

Number of homes sold increased 52.3% vs. last month and decreased 9.3% versus the same month last year.

Months of inventory are down 27.7% vs. last month and down 10.1% compared to the same month last year.

The average days on market decreased by 37% vs. last month and decreased by 27.7% vs. last year.

All information courtesy of and copyright by BAREIS MLS and TrendGraphix.

Dashboard compiled by Thomas Henthorne, all rights reserved.

National Real Estate Market Update

Courtesy of The National Association of Realtors:

“HOME Survey: Housing and Economic Sentiment on Divergent Paths in Early 2018”

WASHINGTON (March 26, 2018) — New consumer findings from the National Association of Realtors® surprisingly show that while a growing share of households in the first three months of the year feel more confident about the economy and their financial situation, those positive feelings are not translating to positive views that now is a good time to buy a home.

That’s according to NAR’s first quarter Housing Opportunities and Market Experience (HOME) survey1, which also found that homeowners are increasingly positive about selling, and non-homeowners have anxieties about saving for a down payment and qualifying for a mortgage.

Heading into the busy spring buying season, optimism that now is a good time to buy a home is at its lowest share in the past two years (68 percent; 72 percent last quarter). Among renters, feelings about buying are further diminished (55 percent; 60 percent last quarter). Conversely, those most optimistic about buying are homeowners, older respondents and those living in the more affordable Midwest and South regions.

NAR Chief Economist Lawrence Yun says extremely challenging market conditions to start the year are chipping away at homebuyer optimism. “The critical shortage of listings in most markets continues to spark a hike in home prices that is not easy for many buyers – and especially first-time buyers – to overcome,” he said. “Adding more fuel to the affordability fire is the fact that mortgage rates have shot up to a four-year high in just a few months. Many house hunters are telling Realtors® that they are dispirited by the stiff competition for the short number of listings they can afford.”

Marin County Real Estate Market Report Charts

(click any slide to enlarge & launch slideshow)

“For Sale” vs. Sold Home Prices vs. Median Home Prices

Marin Home Prices List Price vs. Sold

Marin County Months of Inventory Based on Closed Sales

Average Price Per Square Foot

Marin County Number of Homes on the Market

What This Update Means For You

SELLERS: If you’re thinking of selling your home, don’t listen to your Uncle Fred at dinner who says it is a sellers market and buyers will pay anything. Buyers are well educated and the majority in Marin County are working with very experienced and savvy agents who know values and comparative sales (“comps”). Keep an eye on some of the trends we are seeing — that while inventories remain tight, sellers are having a hard time pushing pricing beyond what the comps would support. Well-prepared and well-priced homes are moving very quickly in this market.

BUYERS: For home buyers, this is a very tough market. An increasing percentage of homes never appear on MLS as they are sold “off-market” as pocket listings or top agent referrals. Work with a well-connected agent and be prepared to move quickly. Chances are you are looking for the same things most other buyers are also seeking (see my list below.) Set up property alerts on my website so you can immediately see new homes on the market, and make sure you are pre-qualified so you present a compelling offer. (You may wish to read my article Buying a Home in Marin County for more tips and advice.) One other tip: Ask your agent to run aged inventory reports in and above your price range. Sometimes there are some real gems that the market has overlooked due to pricing or other factors.

What Are Buyers Looking For Right Now?

In speaking with buyers, they want it all right now, with the following at the top of their lists:

- Great schools

- Single-level

- Easy commute

- Walk to restaurants and shops

- Views

- Quiet streets

- Remodeled homes in move-in condition

Smart buyers, which is almost all of them, realize they cannot have all of those attributes and buying a home in a market like Marin County is a series of tradeoffs. For example, they may choose to give up walking to restaurants to be in the hills with a view of the bay. In any event, we are seeing buyers that are more tech-savvy than ever and who have done their homework, reading market reports such as this one and spending a lot of time online looking at homes.

Wondering If You Should Buy or Rent?

This handy calculator is a great place to start. Then give me a call at 415-847-5584 and let’s discuss.

Would you like to see this data for your town only?

I am also now rolling out market update charts for selected towns in Marin. Please click the below for local real estate market updates & charts:

Corte Madera Real Estate Market Update

Kentfield Real Estate Market Update

Mill Valley Real Estate Market Update

The Golden Gate Sotheby’s International Realty Annual Market Report covering the entire bay area is now out. Please click here to read the report.

I hope you have found my Marin County Real Estate Market Report informative. Please feel free to add your comments, questions or suggestions in the comments section below. If I may be of any assistance in helping you attain your real estate goals, please call or text me at 415-847-5584 and I will be in touch right away.

What do YOU think? What would you like to see in this report going forward? Please leave your comments in the section below.

I like to read this report each month, but each month I get more and more sad that owning a home is more and more out of my reach. Even if I save a down payment, now the interest rates are going up so payments are going up. Thank you, just had to vent.

Hi Veronica, thanks for your comment and I definitely understand where you are coming from. This is a really challenging environment for buyers all over the country. Interest rates have indeed increased, but they are still at historically low levels. When I bought my first condo they were at 7.5%! Please feel free to call me at 415-847-5584 and we can discuss your specific situation. I would love to help you buy a home. And feel free to vent anytime! I appreciate your reading my report each month. Best, Thomas

Another fantastic report. I love how thorough and comprehensive these are. Thank you for including this information — “t is called the California Property Tax Initiative, and would allow homeowners 55 years of age or older to transfer their Proposition 13 tax base to a home of any price, located anywhere in the state, any number of times.” So many people are wondering about this, but unclear. Thanks for sharing.

Thank you, as always, Judy!