Marin County Real Estate Market Report

December 2022

Marin County Real Estate Market Report

December 2022

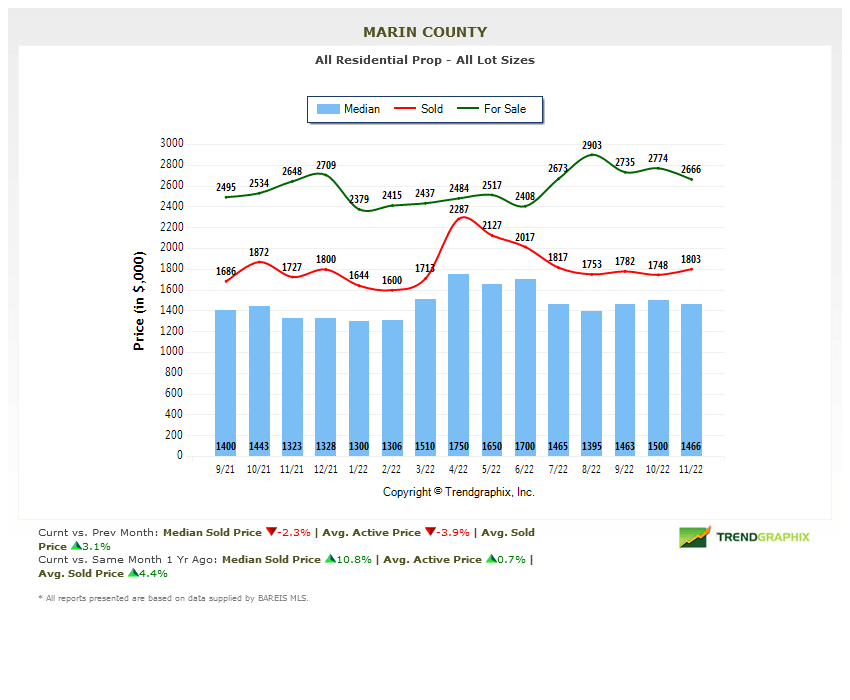

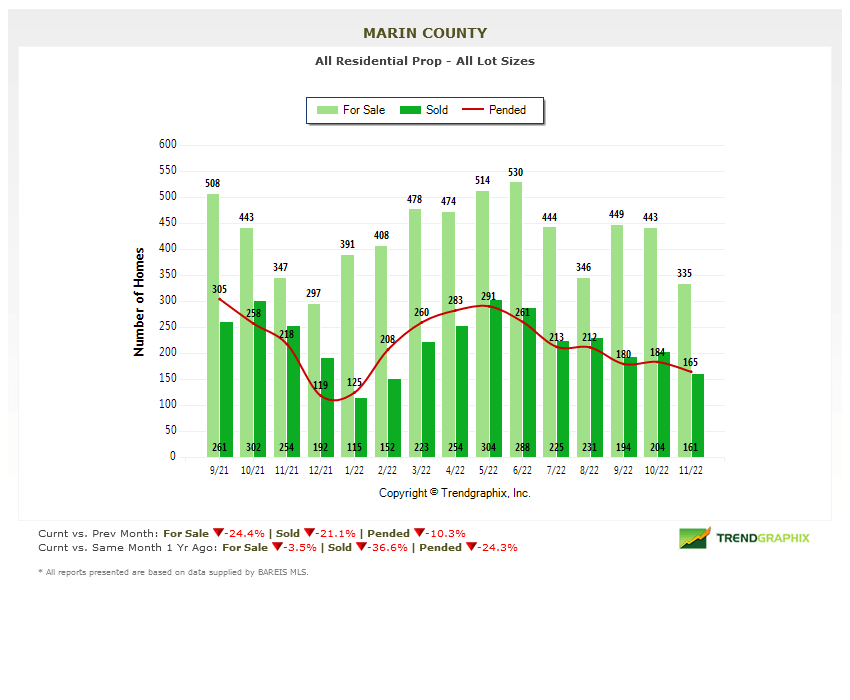

Happy holidays! As the year draws to a close, we continue to see a market which is very different than what we saw earlier this year. It is still a strong market, with median pricing up 11% vs the same time last year to $1.47 million. However we are seeing more price cuts with homes taking longer to sell.

I remain optimistic for a strong spring, barring any significant economic turmoil, as interest rates and the job market stabilize. While we may not see the price appreciation of the past few years, I do not expect significant price erosion based on limited supply and the highly-desirable lifestyle here in Marin County. Home sellers should understand that the record sales prices and bidding wars that they enjoyed during the height of the market in Spring of 2022 have been replaced with a more balanced market.

Having said that, San Francisco continues to struggle, and both Zillow and CoreLogic expect prices to reduce 3.6% there next year. The condominium market is especially vulnerable, described in this article as “cratering” with condo prices down 17% from last year, and many owners choosing to rent rather than sell their condominiums at a significant loss.

Marin County Continues to Be An Attractive Investment

Marin County continues to be an attractive real estate investment for homebuyers, with great schools and close proximity to San Francisco yet easy access to hiking and outdoor activities. Many of our residents when thinking of where to go out to dinner, especially in central and northern Marin, consider wine country in addition to San Francisco and local spots. Remote workers are still able to buy larger homes here than in the city for the same or even a lower price, offering value. We have seen steady long-term appreciation on our real estate market here for the past 50 years.

Don’t count the city out, however. It’s a beautiful, world-class city which will rebound. This might be a good time to consider a purchase there while pricing is down and inventories are expected to be up in the spring.

How Can I Help?

NOW is the time to speak about any real estate plans you may have in 2023 whether buying or selling.Preparing a home for sale takes time as workers are still in short supply (though that is improving), and buying also takes some homework and prep that we should get started before the spring season begins. Let me pave the road to success for you!

Check Out My 2022 Sizzle Reel!

From the Golden Gate Sotheby’s Bay Area Market Report…

SEASONALITY RETURNS TO THE SF BAY AREA HOUSING MARKET

With the approach of the end of the year and seasonal factors coming into play, the housing market continued to slow from the record-setting pace of 2021. The last two months of a year tend to produce lower levels of activity, also referred to as seasonality, and this November was no different.

EMPLOYMENT HEALTHY IN SPITE OF RECENT LAYOFFS

The regional economy remained strong in the face of a growing number of tech industry layoffs. Despite the high-profile layoff announcements from major firms, the unemployment rate in the SF Bay Area remained in the mid-2% range and there are more job openings than workers looking for jobs in many industries. The strong labor market across nearly all industries continued to drive wage growth. The stronger income outlook for households helped convince many potential buyers to return to the market as mortgage rates fell from the recent peak.

MORTGAGE RATE DROP AND PRICE REDUCTIONS ENCOURAGE SALES

The drop in mortgage rates and price reductions by some sellers helped spur sales activity. Though down from last month, the drop in sales of existing homes was on par with seasonal patterns displayed in 2018 and 2019. In November, roughly 2,900 homes sold throughout the SF Bay Area. Activity varied throughout the region, with sales down slightly in San Francisco and dropping the most in Santa Clara and Solano counties. Notably, while San Francisco garners headlines as a slow housing market, monthly sales only decreased by less than 2% after increasing in October.

DEMAND VARIES BY PRICE POINT

Buyer demand for the most aff ordable homes persisted into November. Sales slowed modestly in the $750,000 to $1.25 million range, roughly the mid-point for many cities in the inner SF Bay Area. While the decrease in mortgage rates helped many buyers, solid household income remained key to purchases. Activity fell more for homes less than $750,000, generally a range for buyers where consumer confidence is at a low point given the high pace of inflation. Also of note, sales in the $3.5 million to $5 million range were roughly stable from last month. While this price range typically responds to trends in the stock market, the return to the offi ce for many high-wage earners continued to solidify demand in the SF Bay Area.

WELL-PRICED HOMES STILL SEE COMPETITIVE OFFERS

Despite the reduction in sales volume, competition for well-priced homes remains in most neighborhoods. Among homes closed in November, approximately 34% sold for more than the list price. Though down from earlier peaks, the share is higher than other parts of the country. During the last several months, the share of homes sold at a premium stabilized in the mid-30% range. However, the number of homes sold at a discount increased, highlighting that some sellers may be overly optimistic when listing for sale.

LOOKING AHEAD

While consumer confidence may lag and there are headwinds, including a growing number of announced layoffs and elevated inflation, the regional economy is strong. Household finances are solid as well, potentially leading to increased activity once the economic trajectory is more apparent to consumers. Barring a severe recession, demand for housing, and the incomes to support purchases, will persist into the new year. The reduction in pricing should spur additional buyers off of the sidelines in the coming months, potentially leading to a stabilization of sales activity. Overall, the return to a more normal pace of sales and pricing relative to the frenzied market of the past two years is a positive for the long-term health of the SF Bay Area housing market

What My Clients Are Saying…

Now Available

Just Sold!

6509 Heather Street | Yountville

Gorgeous Walk-to-Everything Bungalow in the Heart of Napa

Just Sold for $1,305,000

Marin Real Estate Market Stats

Marin County Real Estate Market Report Charts

(click any slide to enlarge & launch slideshow)

“For Sale” vs. Sold Home Prices vs. Median Home Prices

Marin Home Prices List Price vs. Sold

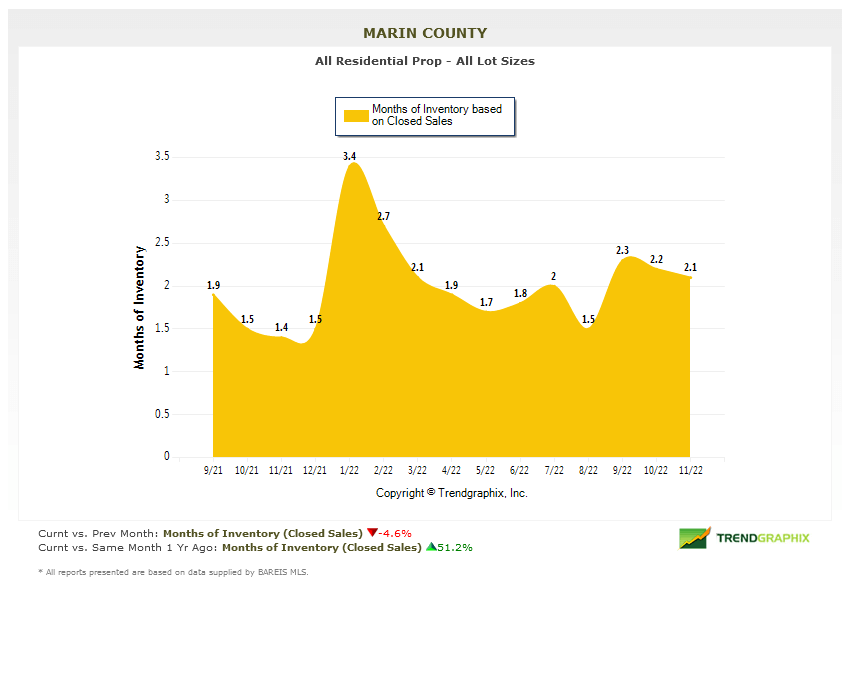

Marin County Months of Inventory Based on Closed Sales

Average Price Per Square Foot

Marin County Number of Homes on the Market

I hope you have found my Marin County Real Estate Market Report informative. Please feel free to add your comments, questions or suggestions in the comments section below. If I may be of any assistance in helping you attain your real estate goals, please call or text me at 415-847-5584 and I will be in touch right away.

Wondering If You Should Buy or Rent?

This handy calculator is a great place to start. Then give me a call at 415-847-5584 and let’s discuss.

Would you like to see this data for your town only?

I am also excited to announce that my website now has new real estate market reports by town with more coming soon. Please check these out:

Belvedere Real Estate Market Report

Corte Madera Real Estate Market Report

Fairfax Real Estate Market Report

Kentfield Real Estate Market Report

Larkspur Real Estate Market Report

Mill Valley Real Estate Market Report

Novato Real Estate Market Report

San Anselmo Real Estate Market Report

San Rafael Real Estate Market Report

Tiburon Real Estate Market Report

These are all accessible from the “Market Reports” menu item here on my website at any time.

Leave a Comment

What do you think?Please leave your comment below!