Marin County Real Estate Market Report

March 2021

Marin Real Estate Market Report March 2021

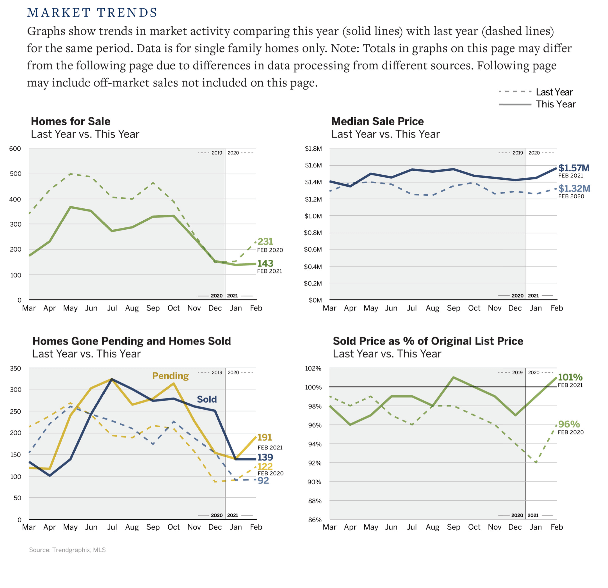

Welcome to my March 2021 Marin Real Estate Market Report! In February we saw a continuation of low inventories and higher pricing, with the median price up 25% vs. the same time last year to $1.55 million. The number of homes for sale was down 37% while days on market were down 35%. It’s a familiar refrain with fewer homes for sale commanding ever-higher sales prices.

Marin Real Estate: My World

I am pleased to announce that I just closed on a commercial / residential building on Sausalito’s waterfront. 26 El Portal just sold for $3,300,000. I also closed on my listing at 922 Ventura Way in Mill Valley for $1,625,000. On the buyer side, I was able to help get my clients into contract and close on 825 Albatross Drive in Novato which was a multiple-bidding situation.

I also just launched 101 Chula Vista Drive in San Rafael, a gated contemporary estate situated on more than an acre, featuring two master bedrooms, gorgeous views and exquisite privacy. It is offered for $2,199,000.

1100 Cabro Ridge, a stunning estate in Novato built on land once owned by Sly of Sly and the Family Stone must be seen to be believed. One person on Facebook said “I didn’t know anything like this existed in Novato!” This private ridgetop estate situated on 11+ acres features captivating views, 20 foot ceilings, an incredible pool area and 6 bedrooms with a detached pool / guest house. Exclusively offered for $4,675,000.

I have a few more homes in the pipeline… stay tuned for details!

Rising Interest Rates and Higher Bond Yields Forecast for 2021

Many of the articles I am reading right now are about the rising interest rates and their impact on the real estate market and the broader economy. The benchmark 10-year treasury yield hit 1.625% last week, its highest level in over a year. In this recent Forbes article, economist Daryl Fairweather (a great name for an economist, by the way!) said “If the $1.9 trillion economic stimulus package that’s set to provide cash relief to Americans and get people back to work is successful, interest rates are likely to inch back up to pre-pandemic levels of about 3.5%. That would alter the dynamics of the housing market, though it wouldn’t necessarily put a damper on it.”

The general consensus at this point from what I am reading is that while interest rates may rise to pre-pandemic levels soon, it is unlikely that will have a significant impact on the housing market in 2021 due to the lack of supply at the national level. Congratulations to those of you who refinanced your homes and took advantage of the low rates!

Wells Fargo: A Rebound in 2021

Wells Fargo just published their March 2021 economic outlook and they are predicting strong growth in 2021, the likes of which we have not seen since 1984. Here’s an excerpt:

The Awakening of the Service Economy and a Much Stronger 2021

“We have revised up our forecast for full-year GDP growth for 2021 to 6.4%. That rate is not only above the consensus expectation, but if realized, it would mark the fastest pace of growth for the U.S. economy since 1984.

The remarkably fast development of several vaccines to beat back the virus and their swift deployment are key factors in the strength of the domestic economy. So, too, is the monetary policy response, which restored order to financial markets as well as the fiscal policy response, which attempts to float the troubled parts of the private sector until a self-sustaining recovery could take hold.The current bill making its way through Congress is the catalyst for our latest upward revision, particularly to consumer spending.

For the vaccines, we owe a debt of gratitude to the global scientific community; for the fiscal policy relief, we owe government debt the likes of which this country has not seen since the Second World War.

The upshot of these combined factors is a re-opening of the service economy, which should propel consumer spending to an unprecedented surge in the middle part of this year.

We expect the Federal Reserve to remain accommodative even as inflation begins to rise. A key risk is that almost every country in the global economy will be experiencing a rebound this year to varying degrees. While it is not our baseline forecast, there is scope for an inflation shock amid this globally synchronized rebound.”

What Are The Current Restrictions on Marin Real Estate?

The restrictions on real estate in Marin County were reduced but there are still some restrictions for everyone’s safety:

- No open houses or broker’s opens are permitted

- Homes (both occupied and vacant) may now be shown after prospective buyers review disclosures and sign COVID-19 affidavits

- Seller may not be at home when it is shown

- All involved in showings must wear personal protective equipment (masks, gloves, etc) and avoid touching anything (railings, doorknobs, etc)

- Only two buyers plus one agent may attend showings

How Can I Help?

These reports are a great place to start, but let’s continue the conversation. I am always happy to discuss the market and the best way to approach buying or selling a home in Marin County or the greater Bay Area. Call or text me anytime at 415-847-5584.

Check Out My New Sizzle Reel!

From the Golden Gate Sotheby’s Market Report…

Real Estate Market is Robust, In Spite of Everything

As we come to the end of the first full year under the pandemic, while the hardships faced by many are immense, the region has persevered. The housing market is relatively robust despite the effects of the COVID-19 pandemic. The Bay Area economy stabilized after weakening modestly at the end of 2021 and early in 2021. With a loosening of restrictions, some businesses were able to rehire staff and reopen locations.

People Returning to the Area

As counties throughout the Bay Area relax business restrictions further, consumer activity should improve and spending rebound. Reopening workplaces, restaurants and cultural and entertainment amenities will drive some households to return to the region. In the past few months, though there is still a net outflow of households, a growing number of individuals that relocated early in the pandemic have returned to the Bay Area.

High Demand / Low Supply

Buyer demand remained elevated even as mortgage rates increased slightly and potential buyers faced limited inventory. In February, 3,276 homes sold throughout the region, an increase of roughly 30% from the previous year. While sales for the month were slightly lower than January, as is typical of seasonal patterns, transaction volume remained constrained by the few available homes.

Looking Ahead

As the vaccine rollout continues and counties move into tiers with fewer business restrictions, the recovery should accelerate for a broader portion of the economy… mortgage rates should remain low in the near term, prompting some buyers to move off the sidelines in 2021. While much still hinges on the vaccines bringing the pandemic under control, the for-sale market in the Bay Area should continue to improve with elevated demand for housing.

Now Available

101 Chula Vista Drive | San Rafael

Gated Contemporary Estate Situated on More Than an Acre

1100 Cabro Ridge | Novato

Private Ridgetop Estate with Captivating “Top-of-the-World” Views

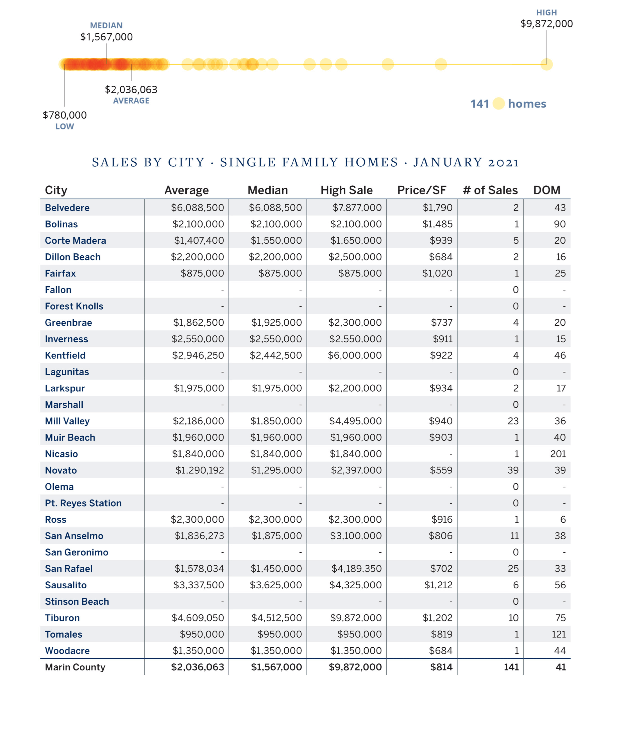

Marin Real Estate Market Stats

Marin County Real Estate Market Report Dashboards

Marin County Real Estate Dashboard:

Home Prices vs. Same Month Last Year

For sale prices increased by 35.4%

Average sold prices increased by 22.7%

The median sold price increased by 25.2%

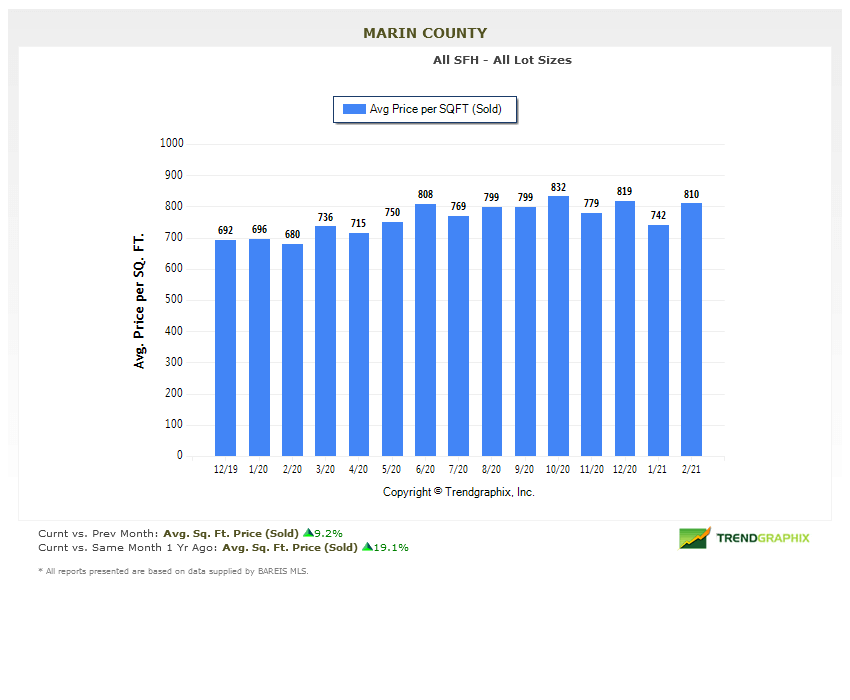

The average price per square foot sold increased by 19.1%

All information courtesy of and copyright by BAREIS MLS and TrendGraphix.

Dashboard compiled by Thomas Henthorne, all rights reserved.

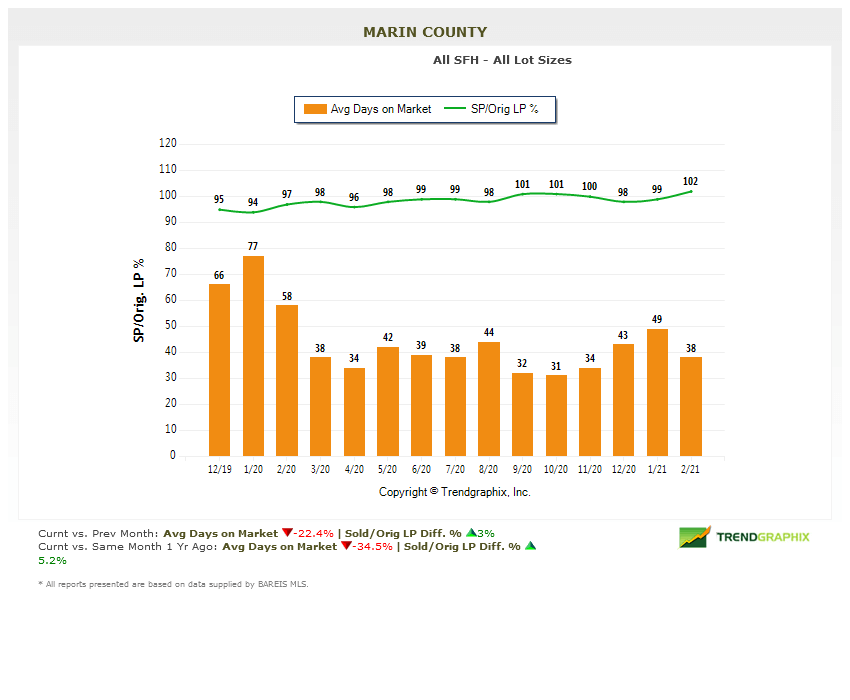

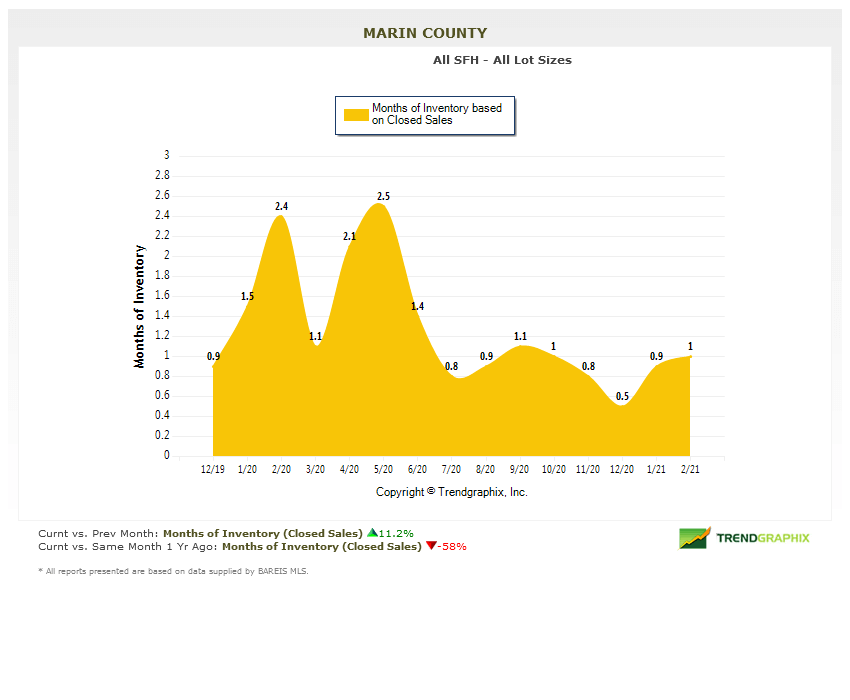

Marin County Real Estate Dashboard:

Inventory Compared to Same Month Last Year

Number of homes for sale decreased by 36.9%

Number of homes sold increased by 58.5%

Months of inventory decreased by 58%

The average days on market decreased by 34.5%

All information courtesy of and copyright by BAREIS MLS and TrendGraphix.

Dashboard compiled by Thomas Henthorne, all rights reserved.

Marin County Real Estate Market Report Charts

(click any slide to enlarge & launch slideshow)

“For Sale” vs. Sold Home Prices vs. Median Home Prices

Marin Home Prices List Price vs. Sold

Marin County Months of Inventory Based on Closed Sales

Average Price Per Square Foot

Marin County Number of Homes on the Market

I hope you have found my Marin County Real Estate Market Report informative. Please feel free to add your comments, questions or suggestions in the comments section below. If I may be of any assistance in helping you attain your real estate goals, please call or text me at 415-847-5584 and I will be in touch right away.

Wondering If You Should Buy or Rent?

This handy calculator is a great place to start. Then give me a call at 415-847-5584 and let’s discuss.

Would you like to see this data for your town only?

I am also excited to announce that my website now has new real estate market reports by town with more coming soon. Please check these out:

Belvedere Real Estate Market Report

Corte Madera Real Estate Market Report

Fairfax Real Estate Market Report

Kentfield Real Estate Market Report

Larkspur Real Estate Market Report

Mill Valley Real Estate Market Report

Novato Real Estate Market Report

San Anselmo Real Estate Market Report

San Rafael Real Estate Market Report

Tiburon Real Estate Market Report

These are all accessible from the “Market Reports” menu item here on my website at any time.

About the Author

Thomas Henthorne is consistently top-ranked, award-winning real estate agent in Marin, helping people buy and sell homes for almost a decade. He writes the #1 real estate blog in Marin County and is a frequent speaker on panels at industry gatherings.

He may be reached at 415-847-5584.

Leave a Comment

What do you think?Please leave your comment below!