The November 2017 Marin County Real Estate Market Report

8 Woodland Place in Kentfield, Photo by Matt McCourtney

Welcome to my Marin County Real Estate Market Report for November 2017.

The North Bay fires are finally out but the victims still need our help. Please join me in donating to the North Bay Fire Relief Fund. A full 100% of donations go to those impacted by the dreadful wildfires. Many of you have asked if the tragic fires up north have had an impact on the market here in Marin County. While it is difficult to say for sure, I did see showings and activity increase after the fire. Normally this time of year we see activity slowing down, but the market is still very strong now. My open houses are busy and buyers are still out in force.

Regular readers of my Marin County real estate market report will note that the trend in past months has continued into October. The number of homes for sale was down 11.4% versus October 2016 with pricing up about 1% versus a year ago, both median pricing and average pricing. While I do not have a crystal ball, if this lack of inventory continues into spring we could see further upward pricing pressure, which will be good for sellers and potentially frustrating for buyers. I am working with several buyers right now who are taking advantage of the lack of competition out there to look for a home before the holidays.

The San Francisco city market, which impacts all the surrounding counties’ markets, continues to slow from its fever pitch. However for every article about it slowing, there is another article about a new record set or a burned out shell of a house going for $800,000. Overall the forecasts I am seeing look for price appreciation more in line with inflation in the coming year in that market. There is a lot of uncertainty around the impact of tax-reform on the California real estate market. More on that in a future column.

October was a busy month in my business. In addition to lining up some exciting listings coming next spring, my listing at 36 Tampa Drive in San Rafael sold for $1,020,000. Also, my gorgeous coastal listing, 125 Calle del Sol Bodega Bay, went into escrow and is due to close in mid-November. I am grateful for your referrals and support.

As always, I am happy to discuss the Marin real estate market with you — just give me a call at 415-847-5584. Please scroll down to see this month’s Marin real estate market graphs.

Fall Leaves in Yountville, Napa County

Marin County Real Estate Market Report November 2017 Dashboards

Marin County Real Estate Dashboard:

Home Prices

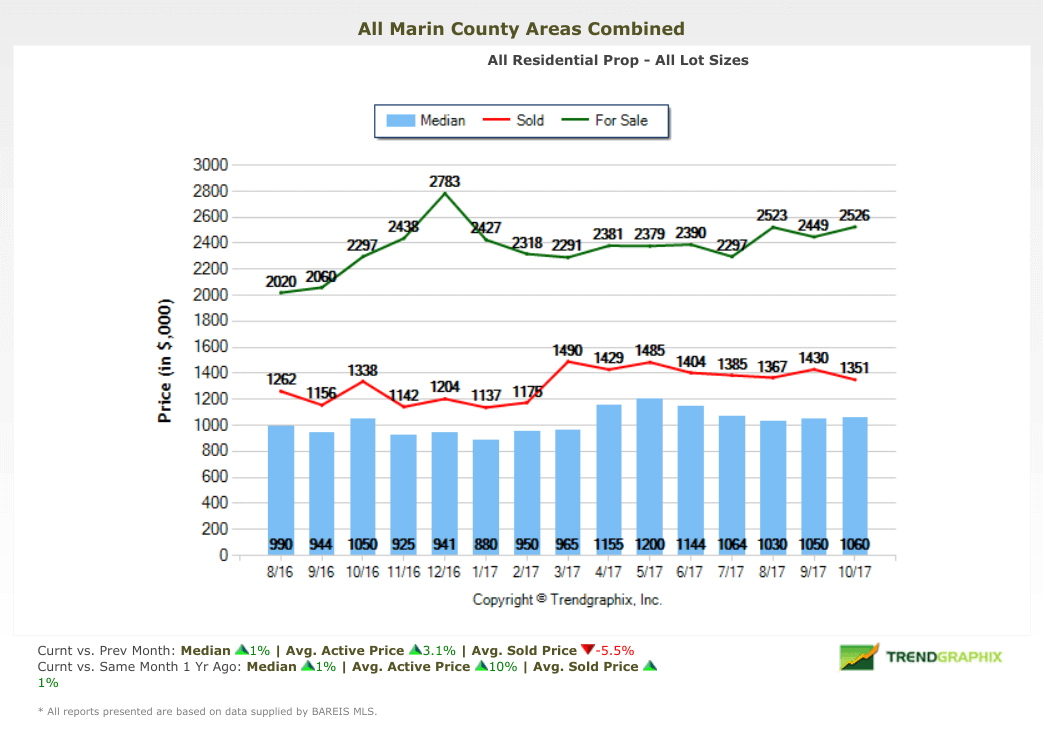

For sale prices increased by 3.1% versus last month and increased by 10% vs. the same month in 2016.

Average sold prices decreased by 5.5% vs. last month and increased by 1% vs. the same month in 2016.

The median home price increased by 1% vs. last month and increased 1% vs. the same month in 2016.

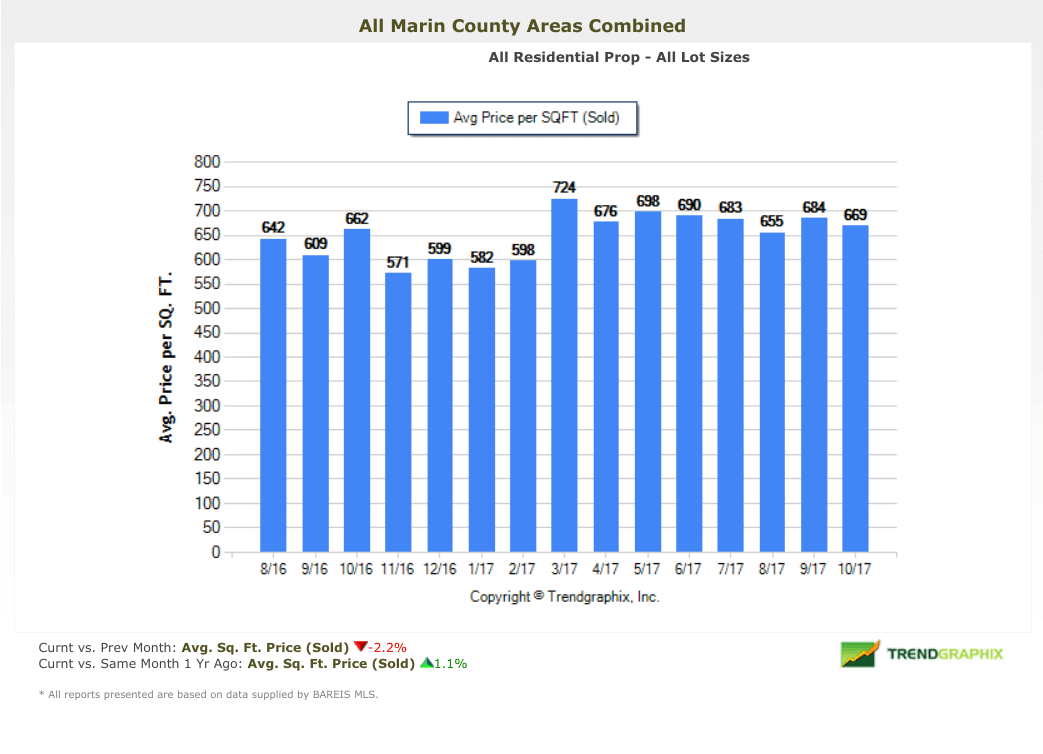

The average price per square foot sold decreased by 2.2% vs. last month and increased by 1.1% vs. the same month last year.

All information courtesy of and copyright by BAREIS MLS and TrendGraphix.

Dashboard compiled by Thomas Henthorne, all rights reserved.

Marin County Real Estate Dashboard:

Inventory

Number of homes for sale decreased 14.3% vs. last month and decreased 11.4% vs. the same month in 2016. New listings decreased 17.2% versus October 2016.

Number of homes sold decreased 2.2% vs. last month and decreased 13.2% vs. the same month in 2016.

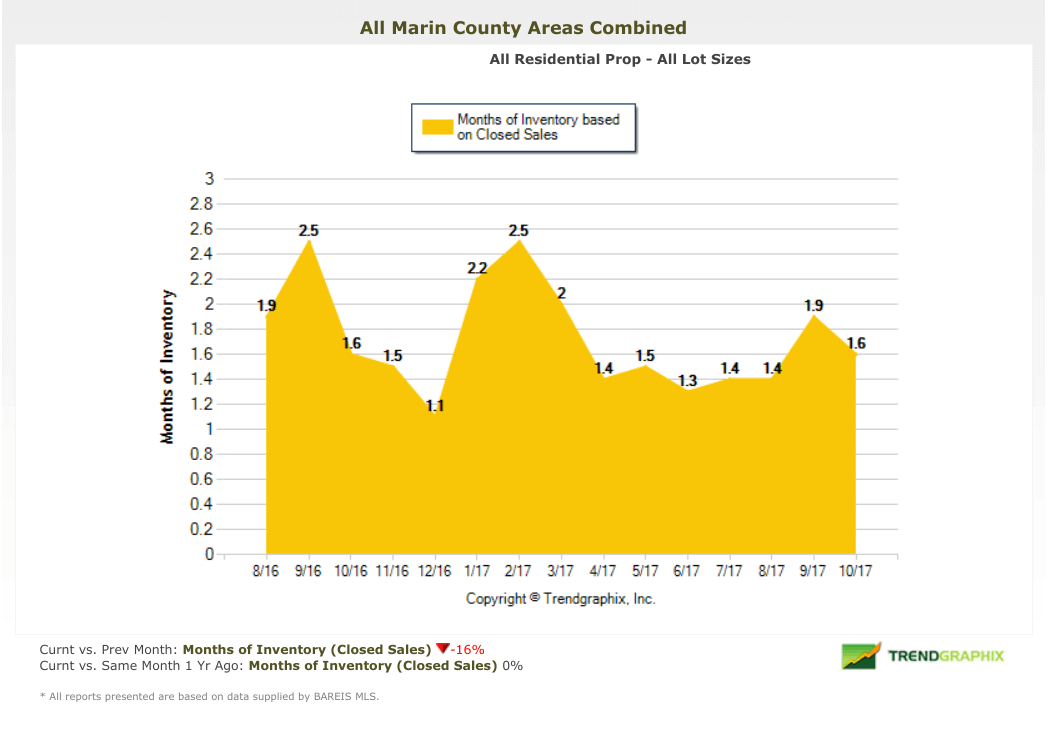

Months of inventory decreased 16% vs. last month and were flat compared to the same month last year.

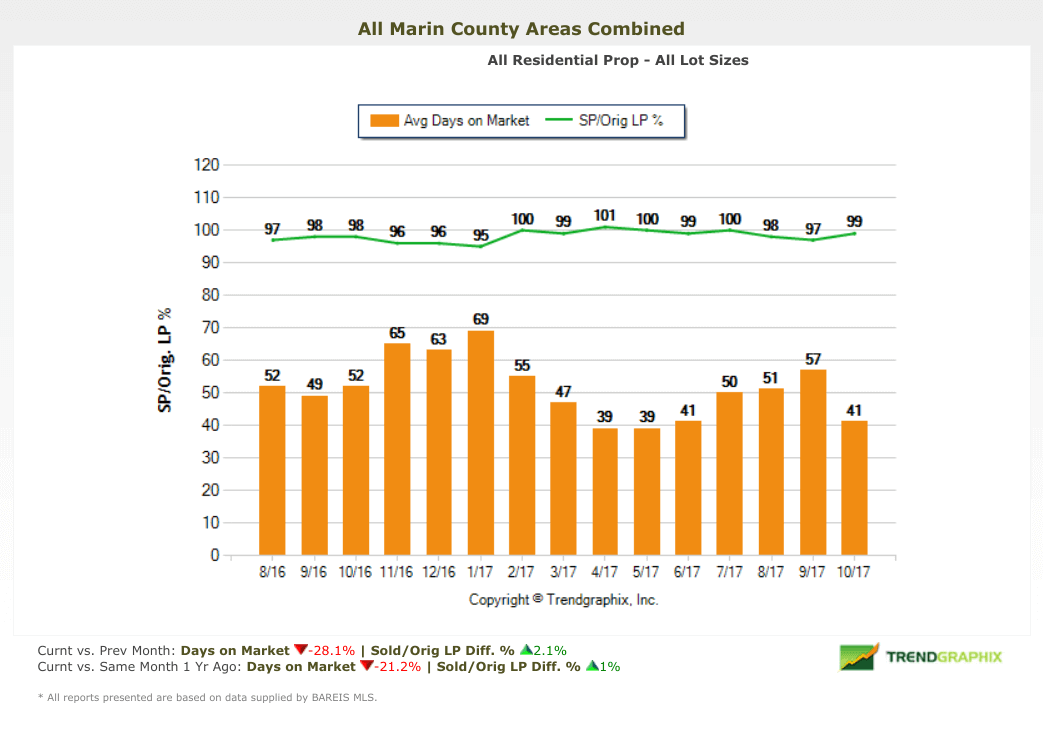

The average days on market decreased by 28.1% vs. last month and decreased 21.2% vs. last year.

All information courtesy of and copyright by BAREIS MLS and TrendGraphix.

Dashboard compiled by Thomas Henthorne, all rights reserved.

National Economic Update

Courtesy of Wells Fargo:

GROWTH MOMENTUM CONTINUES IN Q4

“For the second half of 2017, the growth momentum in the U.S. economy shifted up a gear relative to a year ago. On the domestic side, consumer spending and equipment investment have provided the push. The fundamentals of real disposable income and corporate profit growth have improved over the last three quarters. Gains in employment and an upturn in factory orders indicate further progress ahead. Our outlook is for growth of 2.5 percent in Q4 and 2.6 percent next year.

Inflation continues to surprise–to the downside. Despite the continued decline in the unemployment rate, the PCE deflator is expected to come in at 1.5 percent in Q4—same as Q3. The much awaited acceleration of inflation will wait another day. Meanwhile, the Employment Cost Index has drifted up signifying rising labor cost pressures and potential pressure on profits ahead. Improved growth and steady inflation, along with a lower unemployment rate, provides a basis for another Federal Reserve move to raise the funds rate in December. Meanwhile, the benchmark 10-year rate is expected to continue to drift upward in the fourth quarter and into the first half of 2018. We are still expecting to see some sort of tax cut enacted, but the magnitude will be less than has been proposed and the timing will likely be a bit later. We have shifted effect of the tax cuts into Q2 2018, assuming passage of a $1.5 trillion cut over 10 years in early spring of next year. We anticipate the tradeweighted dollar will continue to decline.”

National Real Estate Market Update

Courtesy of Wells Fargo:

RETURN OF THE AFFORDABILITY MIGRATION

“While the return to the center cities appears to be a shift with staying power, the housing market looks to be shifting back towards some of its long-term norms. For starters, most millennials have always lived in the suburbs, so the aging-up of the group into their peak family-formation years should boost first-time home buying, even if we do not see a shift back toward the suburbs. We expect to see demand shift back toward the suburbs, however, as housing costs in and near most center cities have dramatically outpaced incomes. There is also simply less land to be developed and redeveloped in areas closer-in to center cities, particularly relative to the overall population and overall demand for housing.

The return of the affordability migration is already evident in many of the areas that came of age during the era of automobiles and interstate highways. Los Angeles is one of the best examples. The early part of the economic recovery was largely concentrated in areas close to downtown Los Angeles, which has seen one of the most dramatic makeovers in recent memory, with thousands of new apartments, hotels, restaurants and entertainment venues. Residential development also increased in other close-in areas, including Santa Monica, Venice Beach and much of West Los Angeles. By contrast, demand for housing in inland areas has been slower to come back on-track. The momentum now appears to be shifting back toward the suburbs. Population and employment growth in the Inland Empire has surged over the past year and permits for single-family homes have risen 34 percent. Residential development is also perking up in Ventura County and plans appear to finally be falling in place to bring thousands of new homes to Newhall Ranch located in Santa Clarita, in the northern edge of Los Angeles County. Development is also returning to the suburbs in other historically suburban-driven markets that saw a renaissance in their urban and in-town areas earlier in the decade, including Dallas, Atlanta, Phoenix and Washington, D.C.

With preliminary data now available through September, we have a pretty good idea of where home sales and housing starts will finish 2017. Sales of new homes are expected to rise 8.7 percent, while sales of existing homes rise 0.4 percent. The median price of an existing home is expected to rise 5.3 percent, while the price of new homes should rise a smaller 2.7 percent. The smaller rise in new home prices reflects the shift in construction toward more lower-priced homes, largely in suburban areas in the South and West.”

What This Update Means For You

SELLERS: If you’re thinking of selling your home, don’t listen to your Uncle Fred at dinner who says it is a sellers market and buyers will pay anything. Buyers are well educated and the majority in Marin County are working with very experienced and savvy agents who know values. Keep an eye on some of the trends we are seeing — that while inventories remain tight, sellers are having a hard time pushing pricing higher than last year. Bottom line: price your home for this market, not for the market in early 2016 or 2015.

BUYERS: For home buyers, the good news is that more balance is coming to the Marin real estate market even though inventories are tight. Look for homes that are well-priced and be prepared to move quickly. Chances are you are looking for the same things most other buyers are also seeking (see my list below.) Set up property alerts on my website so you can immediately see new homes on the market, and make sure you are pre-qualified so you present a compelling offer. (You may wish to read my article Buying a Home in Marin County for more tips and advice.) One other tip: Ask your agent to run aged inventory reports in and above your price range. Sometimes there are some real gems that the market has overlooked due to pricing or other factors.

What Are Buyers Looking For Right Now?

In speaking with buyers, they want it all right now, with the following at the top of their lists:

- Great schools

- Single-level

- Easy commute

- Walk to restaurants and shops

- Views

- Quiet streets

- Remodeled homes in move-in condition

Smart buyers, which is almost all of them, realize they cannot have all of those attributes and buying a home in a market like Marin County is a series of tradeoffs. For example, they may choose to give up walking to restaurants to be in the hills with a view of the bay. In any event, we are seeing buyers that are more tech-savvy than ever and who have done their homework, reading market reports such as this one and spending a lot of time online looking at homes.

Wondering If You Should Buy or Rent?

This handy calculator is a great place to start. Then give me a call and let’s discuss.

Marin Real Estate Market Report Charts

(click any slide to enlarge & launch slideshow)

“For Sale” vs. Sold Home Prices vs. Median Home Prices

Marin Home Prices List Price vs. Sold

Marin County Months of Inventory Based on Closed Sales

Average Price Per Square Foot

Would you like to see this data for your town only?

I am also now rolling out market update charts for selected towns in Marin. Please click the below for local real estate market updates & charts:

Kentfield Real Estate Market Update

Mill Valley Real Estate Market Update

I hope you have found my Marin County Real Estate Market Report informative. Please feel free to add your comments, questions or suggestions in the comments section below. If I may be of any assistance in helping you attain your real estate goals, please call or text me at 415-847-5584 and I will be in touch right away.

Please subscribe to my blog to receive my latest articles and market reports via email:

What do YOU think? What would you like to see in this report going forward? Please leave your comments in the section below.

Sounds like October was a great month. Another wonderful report. Looking forward to seeing how November closes out and sets us up for December. Happy Holidays!